Why Small Business Owners Are Paying Attention to Telematics Commercial Auto Programs

When your business depends on wheels to keep things moving, commercial auto insurance is a necessary cost, but lately, that cost feels like it’s climbing out of control. One fender bender, one speeding ticket, or one too many claims on your record, and suddenly your premiums don’t just go up, they skyrocket.

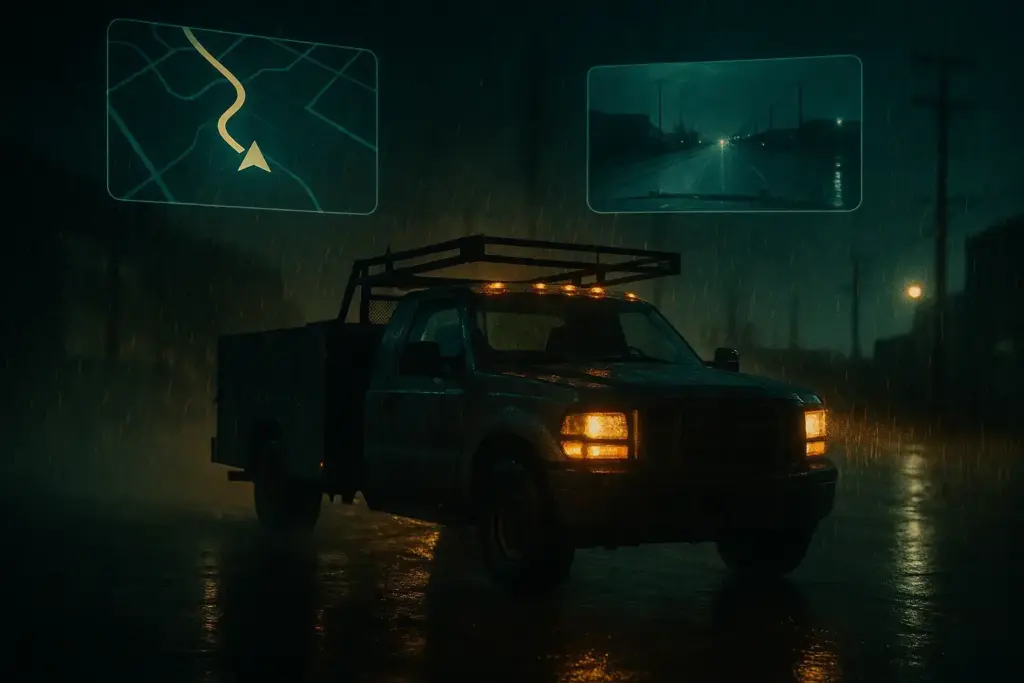

That’s why more small business owners are taking a hard look at telematics commercial auto programs. These aren’t just black boxes tracking mileage anymore. Today’s systems combine GPS tracking, vehicle diagnostics, and dash cams to give you real-time insights into how your vehicles are being used, and how your drivers are performing.

The result? More control, fewer surprises, and real savings.

In this article, we’re going to walk through four clear ways telematics and dash cams are helping business owners take back control of their insurance costs, boost safety across their teams, and protect what matters most. Whether you run a fleet of trucks or just a couple of work vans, this tech is more accessible, and more valuable, than ever.

What Is Telematics (and Dash Cam Integration) in Commercial Auto Insurance?

Telematics might sound like something built for long-haul trucking companies or massive fleets, but it’s quickly become one of the most effective tools for small businesses trying to lower risk and control costs.

At its core, telematics for commercial auto technology uses a device installed in your vehicle to collect real-time data. That includes GPS location, speed, braking, idling time, route history, and even how hard someone takes a corner. This information is sent back to you, and sometimes to your insurer, giving a clear picture of how your vehicles are actually being driven on the road.

But here’s where things really get useful: dash cams.

When telematics systems are paired with front-facing (and sometimes dual-facing) dash cams, you’re not just seeing the what, you’re seeing the why. A harsh braking alert tells you something happened. The dash cam footage shows you if your driver was cut off by another car or following too closely. That kind of context can make the difference between your insurance company paying a claim or denying it.

Why This Matters for Small Business Owners

Most local business owners don’t have a fleet manager sitting in an office watching dashboards all day. You’re juggling quotes, job sites, and payroll. Telematics and dash cam systems work in the background, quietly collecting data that helps you make smarter decisions without adding more to your plate.

With the right setup, you can:

- Spot patterns in driver behavior before they become liabilities

- Get alerts about risky driving or mechanical issues

- Protect your business with video evidence if there’s an accident

- Prove your side of the story when it counts

Whether you’ve got a single delivery van or a small team of vehicles, telematics commercial auto tools give you something every business owner wants: control without babysitting.

And the best part? This tech used to be expensive and complicated. Now it’s affordable, plug-and-play, and often supported directly by your insurance carrier.

Paying Less Without Cutting Coverage: How Telematics and Dash Cams Lower Insurance Costs

Let’s get straight to the point: commercial auto insurance is expensive, and for small businesses, it often feels like there’s no way around it. But that’s changing fast, telematics commercial auto programs are giving business owners a smarter path to savings without sacrificing the protection they need.

How Telematics Helps Lower Premiums

Insurance companies set premiums based on risk. The higher the risk they think you are, the more you pay. Without any driving data, most carriers have to lump you into a general category based on your industry, vehicle type, and ZIP code. That’s where telematics changes the game.

When you opt into a telematics commercial auto program, you’re giving your insurer something valuable: real, measurable driving data. If your drivers operate safely, meaning fewer hard stops, lower speeds, and consistent driving habits, you’re often rewarded with better renewal terms.

It’s not just about being a good risk, it’s about being able to prove it.

Dash Cams Add an Extra Layer of Protection

Now add dash cams to the equation. Let’s say one of your trucks is sideswiped on the highway. The other driver blames your team, but the dash cam tells a different story. With clear video footage, your business avoids paying for an accident it didn’t cause.

That’s not just peace of mind, it’s money saved.

Here’s where the savings start to stack up:

- Fewer claims filed thanks to clear video evidence

- Faster claims resolution, avoiding costly legal battles

- Improved driver behavior leading to long-term premium reductions

- Reduced fraud risk, which insurers take seriously when pricing policies

A Real-World Example (Hypothetical)

Imagine a small landscaping company with five service trucks. After adding telematics and dash cams, they notice one driver consistently speeds and brakes hard. A quick conversation leads to better driving, and fewer alerts. A month later, another truck gets cut off on a busy road and ends up in a fender bender. The dash cam shows the full story, and the insurance company quickly closes the claim with zero payout from the business’s policy.

No rate hikes. No stress. Just proof that the system works.

Building Safer Habits: Coaching Drivers with Real Data and Video Insights

You can’t fix what you can’t see. That’s the problem many small business owners face when it comes to fleet safety. You hire good people, but once they’re out on the road, it’s a mystery. Are they speeding through school zones? Tailgating in traffic? Burning extra fuel with aggressive stops and starts?

With telematics commercial auto systems, especially when paired with dash cams, you stop guessing and start seeing.

Real Data, Real Behavior

Telematics tools track things like:

- Speeding incidents

- Harsh braking and cornering

- Excessive idling

- Route inefficiencies

Dash cams take it one step further by showing exactly what happened, and why. That means you can talk to your team about real situations, not vague complaints or hearsay. It turns performance reviews from uncomfortable lectures into constructive conversations.

From Monitoring to Coaching

The goal isn’t to micromanage, it’s to build a culture of safety. Most drivers want to do a good job. But bad habits can creep in, especially when no one’s watching.

With weekly driver scorecards, performance reports, and access to video footage, you can:

- Spot patterns early and coach accordingly

- Set clear safety expectations backed by data

- Recognize top-performing drivers with real evidence

It’s not about catching people, it’s about helping them improve. In fact, many business owners report that once drivers know there’s visibility into their habits, behavior improves almost overnight.

A Smarter Way to Reduce Risk

Insurance companies love this too. A safer fleet means fewer claims, which puts you in a better position at renewal. Some insurers even offer extra savings or incentives when your drivers hit certain safety benchmarks tracked through telematics commercial auto programs.

And when a driver does make a mistake? Dash cam footage gives you context. Maybe that hard brake wasn’t careless, it was a smart move to avoid an accident. Without video, it’s your word against someone else’s. With video, it’s the truth.

Stopping Trouble Before It Starts: Real-Time Alerts from Telematics and Dash Cams

In a perfect world, you’d catch problems before they cost you money, but when your team is on the road, problems often show up too late. That’s where telematics commercial auto systems and dash cams step in as early warning tools that help protect your business before things go sideways.

Real-Time Alerts That Actually Matter

Most modern telematics systems send immediate alerts when something out of the ordinary happens. Think of it as having a second set of eyes on your fleet, 24/7. You’ll know right away if:

- A driver is speeding through a residential zone

- A vehicle brakes too hard or swerves unexpectedly

- A van sits idling for 30 minutes in a parking lot

- A check engine light comes on mid-route

Instead of waiting for a call after an accident or breakdown, you’re already in the loop, and ready to act.

Dash Cams Provide the Full Picture

Here’s where dash cams take those alerts to the next level. An alert tells you something happened. The video shows you why. Did your driver slam on the brakes because of a squirrel in the road, or because they were tailgating in traffic?

Having both the data and the footage gives you full visibility, which means smarter decisions, faster.

Imagine this: one of your service trucks sends an alert for harsh braking and rapid acceleration. Normally, that might seem like reckless driving. But a quick look at the dash cam shows the truck had to avoid a driver who ran a red light. That’s not bad driving, it’s defensive driving.

Maintenance, Theft, and More

Real-time alerts also help you catch vehicle problems before they become downtime disasters. Some telematics commercial auto programs integrate engine diagnostics that let you know when it’s time for an oil change, brake service, or tire rotation, so you stay ahead of costly repairs.

You can also use location tracking to:

- Monitor routes in real-time

- Recover stolen vehicles

- Confirm job site arrivals and departures

That’s not micromanaging, it’s protecting your bottom line.

Prevention Pays

Every incident you prevent is one less claim on your record. One less rate hike. One less angry client wondering why your team didn’t show up.

By catching problems early, you keep your team safer, your clients happier, and your insurance premiums more stable. That’s the real power of telematics commercial auto systems and dash cam integration, it’s not just about recording what went wrong. It’s about keeping things from going wrong in the first place.

Telematics and Dash Cams Put You Back in Control

Running a business is hard enough without surprise rate hikes, false claims, or drivers making mistakes you never saw coming. That’s why more business owners are turning to telematics commercial auto systems, not for the tech itself, but for the control it gives them. Paired with dash cams, these tools offer a clear view of your fleet, your risks, and your opportunities to save.

You get safer drivers, faster claims, and fewer headaches. And the best part? You don’t have to cut coverage to cut costs.

If you’re ready to take the guesswork out of fleet insurance, learn more about our Commercial Auto coverage and how we help small businesses protect what matters, without wasting money or time.