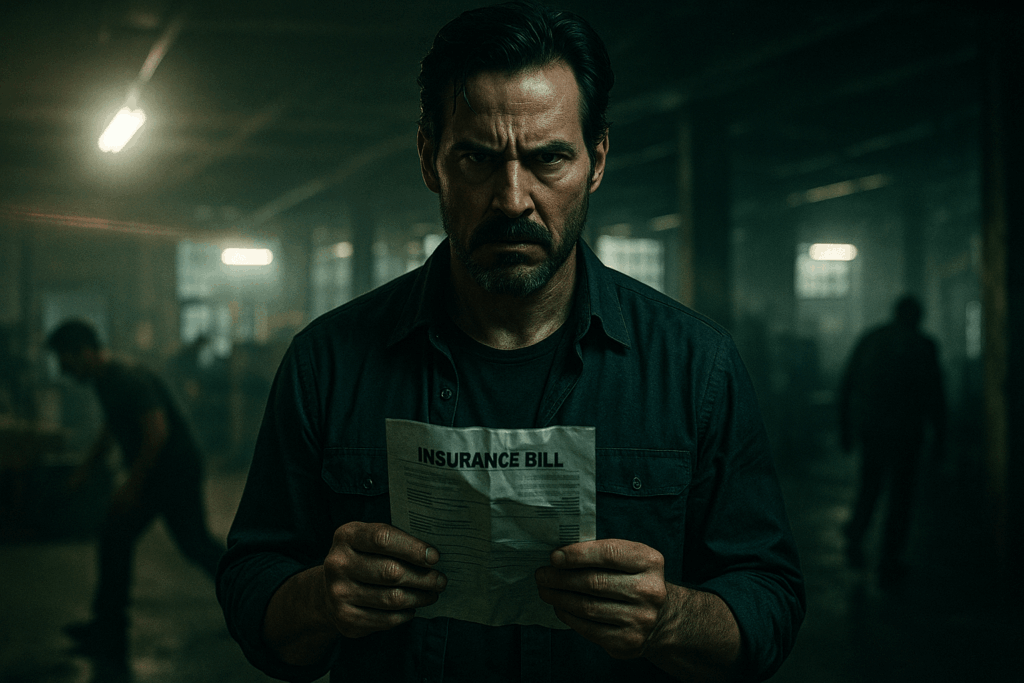

The Unexpected Bill That Woke Brian Up

Brian didn’t think much of the envelope when it showed up in his Monday morning mail pile. Just another renewal, probably. But the number at the bottom made his stomach drop. His workers comp insurance cost had jumped by thousands, and he had no idea why.

He hadn’t hired anyone new. No major incidents. No changes to the work his crew was doing. So what changed?

Like a lot of business owners, Brian had assumed workers’ comp was a “set it and forget it” kind of thing. But now he was staring down a premium he hadn’t budgeted for, wondering what he missed, and how to avoid getting blindsided again.

If you’ve ever felt that same confusion, you’re not alone. Workers comp insurance cost is shaped by more than just how many employees you have or what they do. It’s a combination of behind-the-scenes factors that can shift over time, often without you realizing it.

Let’s break down the biggest things that impact your premium, so you can stop guessing and start making moves that actually protect your bottom line.

Industry Classification: Why Your Business Type Shapes Your Bill

Not all jobs carry the same level of risk, and when it comes to workers comp insurance cost, the work your employees perform plays a huge role in what you pay.

Every business is assigned one or more classification codes that describe the type of work being done. These codes are set by state rating bureaus or national agencies like NCCI (National Council on Compensation Insurance). They exist to group businesses with similar risk levels, which helps insurance carriers price premiums more accurately.

Here’s the catch: if your business is classified under a code with higher injury rates, your premium goes up, even if your team has never filed a claim.

Let’s say Brian owns a home renovation company. If he lists his office staff under a general clerical code, that portion of his payroll gets a lower rate. But if he accidentally groups them in with his roofing crew (a high-risk classification), his workers comp insurance cost will spike for no good reason. One mistake in classification can cost thousands each year.

Even more frustrating? These codes aren’t always obvious, and they can vary slightly by state. Sometimes, the job description you give your agent matters more than the actual job itself. Miscommunication, outdated records, or even clerical errors can land your business in the wrong bucket.

Tip: It’s worth taking the time to review your classifications line by line. Some business owners find they’ve been misclassified for years, paying inflated premiums the whole time.

The bottom line: the kind of work your employees do isn’t just about job titles, it’s about risk categories. And getting it right can make a major difference in your overall workers comp insurance cost.

Payroll Size: The Bigger the Team, the Bigger the Price Tag

You probably already know that workers’ comp premiums are tied to payroll. But what many business owners don’t realize is just how directly payroll drives the overall workers comp insurance cost, and how easy it is to get caught off guard.

Here’s how it works: for every $100 of payroll, there’s a set rate based on your industry classification. Multiply that rate by your total payroll, and that’s your base premium. Sounds simple enough, but the math adds up fast.

Let’s go back to Brian. He runs a team of ten full-time employees and brings on seasonal help in the summer. Last year, he gave everyone a raise to stay competitive, and brought in two part-timers during a busy stretch. Great for morale and productivity. But when his policy came up for renewal, his workers comp insurance cost jumped significantly.

Why? Because he increased his total payroll without realizing what that would do to his premium.

Even small changes like overtime, bonuses, or adding part-timers can push your payroll into a new bracket. And if you underreport payroll to save money upfront, you could be in for a rude awakening during your annual audit, when the insurance company adjusts your premium based on actual figures, not estimates.

Common pitfall: Some business owners try to “guesstimate” their payroll to keep costs down. But if your guess is too low, you’ll owe the difference later, and possibly face penalties.

Smart move: Track payroll accurately and update your agent anytime you make significant changes to your team. It’s the easiest way to stay in control of your workers comp insurance cost and avoid sticker shock later.

At the end of the day, payroll reflects the size of your exposure. More employees (or higher wages) mean more potential risk, and the insurance company prices accordingly. Being proactive about payroll reporting won’t just keep your premiums accurate, it might save your business from a budget surprise down the line.

Claims History: When the Past Comes Back With a Bill

Nothing makes your workers comp insurance cost rise faster than a shaky claims history. You might think past incidents are water under the bridge, but insurance companies see them as a crystal ball for future risk, and they price your policy accordingly.

This is where something called an experience modification rate (EMR) comes in. It’s a score based on your claims record compared to others in your industry. A perfect EMR is 1.0. Stay below that, and your premium goes down. Go above it, and you’ll pay a surcharge. In other words, your past is directly tied to your present price tag.

Brian found this out the hard way. Two years ago, one of his warehouse workers, Joe, slipped while unloading a truck. The injury didn’t seem major at the time, and Brian thought the claim was handled. But it turned out to be more expensive than expected, with physical therapy and lost wages piling up. That single claim raised Brian’s EMR, which made his workers comp insurance cost climb, not just once, but for multiple renewal cycles.

And that’s not unusual. Even one significant claim can stay on your record for three years or more.

So how do you protect your premium going forward?

- Start with prevention. Regular safety training, clear job procedures, and well-maintained equipment can reduce accidents before they happen.

- Have a return-to-work plan. Helping injured employees ease back into their role, even part-time, can limit wage replacement costs and keep claims from ballooning.

- Report incidents quickly and accurately. Delays or errors in reporting can complicate the claim, and that usually means higher payouts.

Here’s the thing: insurance companies aren’t just looking at what happened, they’re watching how you respond. A business with a proactive approach to safety and a few small claims may be seen as less risky than one with a big claim and no plan to prevent the next one.

Bottom line? If you want to control your workers comp insurance cost, keeping a clean claims history isn’t just a nice-to-have, it’s one of the most powerful tools you’ve got.

State Regulations & Carriers: Why Location and Provider Matter

Even if two businesses look identical on paper, same size, same industry, same payroll, their workers comp insurance cost can vary dramatically just based on where they’re located and which insurance company they use.

Let’s start with state regulations. Workers’ comp is regulated at the state level, and no two states handle it exactly the same. Some require you to buy coverage through a state fund. Others allow you to shop the open market. A few even use a hybrid model that mixes both. These rules don’t just impact where you buy your policy, they also affect the rates, available discounts, and what’s covered.

For example, Brian’s business operates in two states. One has a competitive private market where he can shop rates across several carriers. The other only allows coverage through the state’s assigned risk pool. The difference in pricing and flexibility? Huge. And because each state sets its own base rates and benefits structure, the same employee doing the same job can cost more to insure depending on their zip code.

Then there’s the carrier side of the equation. Not all insurance companies view your risk the same way. Some specialize in certain industries and offer better rates for businesses like yours. Others might be more conservative and charge more to offset what they see as riskier operations. Even if your classification and payroll are spot on, your choice of provider can heavily influence your workers comp insurance cost.

Here’s where many business owners go wrong: they stay with the same carrier year after year without checking if their current rate is still competitive. Or worse, they bounce between carriers chasing short-term savings, only to end up with gaps in coverage or misaligned classifications.

The smarter approach? Work with someone who knows both the insurance landscape and your industry. The right advisor will help you understand how your state laws and market options affect your pricing, and guide you toward carriers that reward your safety record and payroll setup, not penalize it.

In short, where you operate and who you’re insured with aren’t just administrative details, they’re major drivers of your workers comp insurance cost. And they’re often overlooked until the renewal bill shows up.

The Cost of Not Paying Attention

Brian’s story is a common one. A renewal notice hits the inbox, the premium’s gone up, and no one can explain why. But now he knows better. The real drivers of your workers comp insurance cost, your classification codes, payroll, claims history, and even your location, aren’t just paperwork. They’re levers you can actually manage when you know what to look for.

You don’t need to become an insurance expert to protect your bottom line. You just need a partner who can explain things clearly and help you make smart decisions before the next audit or surprise hike. If you haven’t had someone walk you through your current coverage lately, don’t wait until it’s too late.Start by reviewing your policy with someone who knows how to simplify the process. Here’s a solid place to begin: Workers Compensation Insurance.